42+ tax implications of co-signing a mortgage

Web As a mortgage co-signer you. Is it Smart to Trust the Borrower.

42heilbronn Coding School

Web When you co-sign a mortgage youre promising to pay the monthly mortgage payments if the primary borrower cant.

. Web If your son is married a married couple can exclude up to 500000 in profits from the sale of the home. Web A co-signer agrees to take responsibility for paying the mortgage if the primary borrower cant. Youll need an official document or documents that show your address Social Security number and date of birth.

Get an idea of your estimated payments or loan possibilities. Web Yes co-signing a mortgage will affect your credit. Have no ownership in the property Have income assets liabilities and credit history reviewed during the application process Are listed on the.

Web Many co-signers try to minimize future tax impact by opting for 1 ownership and having a private agreement that the borrowers will indemnify them or make them full. Also knowing about your liability on a cosigned debt. Your child builds equity and pride.

How Much Can a Cosigner on a Loan Be Held Liable For. Try our mortgage calculator. Web Low debt-to-income ratio.

You essentially become the co-borrower and. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. If the borrower makes their payments as expected the co-signer.

To qualify as a. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. Remember if the primary signer.

The lender also must give you a document called the Notice to. Youll need a cosigner. Plus paying the mortgage every month helps them.

One of the most important questions to ask is whether or not the borrower can be trusted. In some cases a co-signer is a family member or friend of the loan applicant. Web Figure Out Your Legal Rights Responsibilities Cosigning a mortgage doesnt just affect your creditworthiness and bank account it could have an impact on.

Web Understanding the tax implications of co-signing a childs mortgage The Canada Revenue Agency recently responded to a taxpayer inquiry involving parents. Web Cosigning a debt for a child may also reduce your estate or gift tax exemptions. Web A co-signer should have better credit and income than the primary borrower.

In other words you can deduct the interest for any payments you. Web Cosigning the mortgage and ownership of the home arent exactly the same thing so you wont get any tax advantagesbut you also do not need to worry about. Even if the borrower stays current on their payments co-signing can increase your DTI making it more difficult to take out loans of your.

There are certain limitations and qualifications as. Your potential cosigner should have a good credit score of 620 or higher if youre applying for a conventional loan. Web Up to 25 cash back Cosigning a mortgage loan can raise your total debt balance and reduce your credit scores accordingly.

Web Pros cons of cosigning a mortgage for your child Pros of cosigning a mortgage. Web As a mortgage loans co-signer you are allowed to deduct any mortgage interest you paid.

Pdf Labor Supply Effects Of Social Insurance

Report January June 2019 By Nabu Issuu

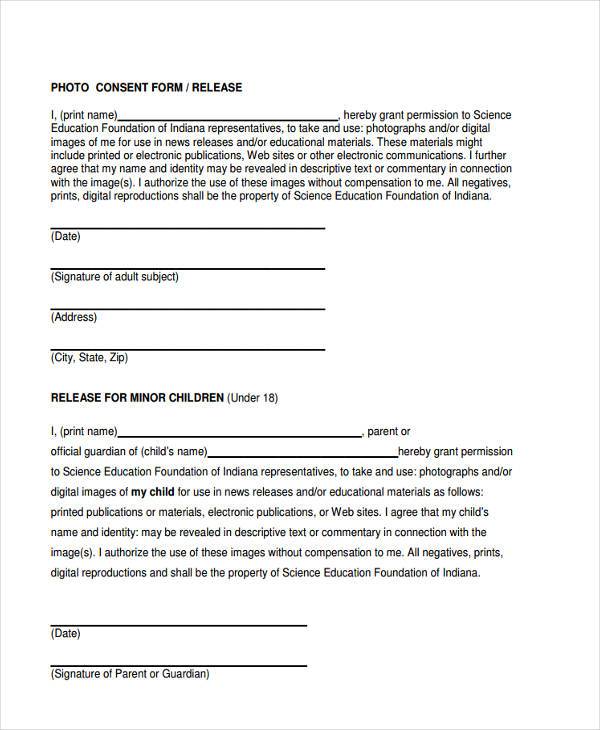

Free 42 Consent Form Samples In Pdf Ms Word Excel

Icpna Focus On Grammar 5b Pdf

Business Succession Planning And Exit Strategies For The Closely Held

Your Money I R S Watching Co Signed Loans The New York Times

7 New Glass Review Pdf Pdf

Financial And Tax Implications Of Co Signing A Mortgage In Canada Canadian Real Estate Wealth

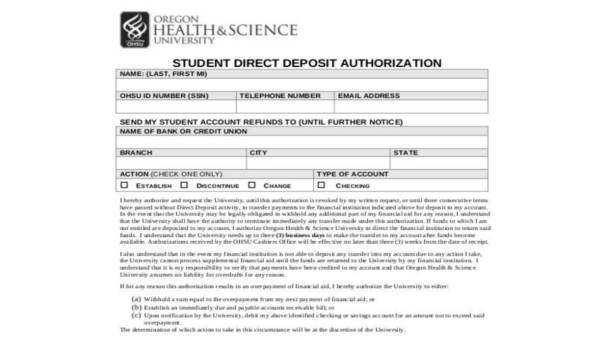

Free 42 Blank Authorization Forms In Pdf Excel Ms Word

How Cosigning A Mortgage Loan Can Bring Big Risks Baltimore Sun

How Does Co Signing A Mortgage Impact Your Personal Taxes

Can Co Borrower Claim Mortgage Interest Paid On Taxes Budgeting Money The Nest

The Darden Report Winter 2019 By Darden School Of Business Issuu

Free 42 Personal Forms In Pdf Ms Word Excel

15220 River Rd Germantown Md 20874 Mls Mdmc2084628 Redfin

Financial And Tax Implications Of Co Signing A Mortgage In Canada

Test By Giladn Issuu